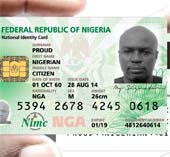

The President of Nigeria Goodluck Jonathan received his eID card last month, heralding the official launch of the eID pilot. In the trial phase, the Nigerian Identity Management Commission (NIMC) will issue MasterCard-branded identity cards, which allow electronic payments, to 13 million Nigerians. This is the largest rollout of a biometric-based verification card with electronic payment in the country and the broadest financial inclusion scheme in Africa. NIMC is to create and run the country’s first central National Identity Database and provide proof of identity to Nigerians aged 16 and over.

With 13 applications, including MasterCard’s prepaid payment and Cryptovision’s biometric identification, the eID card will provide millions of Nigerians – most of whom have never had access to a banking product – with electronic payments.

At a celebratory event in Abuja, Goodluck Jonathan said: “I am happy that this important milestone of the rollout of the National Identity Management System has been realized today. I am impressed with the quality of the eID card and the work of the corporate partners that made it possible. I commend especially MasterCard, and Access Bank Plc, as well as the Commission [NIMC] for achieving a world-class product.”

He said the card builds a window to a social security benefit system and therefore, it is a card every Nigerian should get.

NIMC is working with several government agencies to integrate identity databases including the Driver’s License, Voter Registration, Health Insurance, Tax, SIM and the National Pension Commission (PENCOM) into a single, shared services platform. Chris ‘E Onyemenam, Director General and CEO of NIMC, said: “The National eID program enables us to create an optimized common platform for Nigerian citizens to easily interact with the various government agencies and to transact electronically. There are many use cases for the card, including the potential to use it as an international travel document, which will have significant implications for border control in Nigeria and West Africa. In close collaboration with both the public and private sectors to achieve the full potential of this program, NIMC is focused on inclusive citizenship, more effective governance, and the creation of a cashless economy, all of which will stimulate economic growth, investment and trade.”

NIMC is the project lead, MasterCard the payments technology provider, Unified Payment Services Limited the payments processor, Cryptovision the Public Key Infrastructure provider, and pilot issuing banks include Access Bank Plc,.

“This is a memorable occasion for MasterCard as we witness the start of a financial inclusion program that is unprecedented in scale and scope,” says Daniel Monehin, Division President of Sub-Saharan Africa, MasterCard. “Combining an identity card with MasterCard’s prepaid payment capability creates a game changer as it breaks down one of the most significant barriers to financial inclusion – proof of identity – while simultaneously enabling Nigerians to access the global economy.”

He said the broader economic impact of the card will be felt as the previously unbanked and under-banked are able to gain access to the mainstream economy, and the visibility of their assets allows them to build a financial history and establish credit-worthiness with financial institutions.

Using the card as a payment tool, Nigerians can deposit funds, receive social benefits, save, or engage in many other financial transactions that are facilitated by electronic payments with the extra security assurance of biometric verification. They can also pay for goods and services and withdraw cash at millions of merchants and ATMS that accept MasterCard payment cards in Nigeria and in more than 210 countries and territories globally. MasterCard has unsurpassed merchant acceptance; no other brand is more widely accepted. The card also has the added safety and security benefits offered by the EMV Chip and Pin standard.

To receive the eID card, Nigerians aged 16 and above need to register at one of the hundreds of NIMC enrolment centres. The enrolment process involves the recording of an individual’s demographic data and biometric data (capture of ten fingerprints, facial picture and Iris) to authenticate the card-holder and ensure that there are no duplicates on the system. Upon registration, NIMC issues each Nigerian with a unique National Identification Number (NIN), followed by the national eID card. Upon completion of the pilot, NIMC plans to introduce more than 100 million cards to Nigeria’s 167 million citizens.